It is no secret that the financial world is entirely dependent on data. It’s a delicate and complex business where one digit can make all the difference. Time and again, there have been attempts to renovate and simplify financial presentations. However, with the constantly evolving world and changing dynamics of information technology, little attention is paid to creative presentations of financial products – until InsMark.

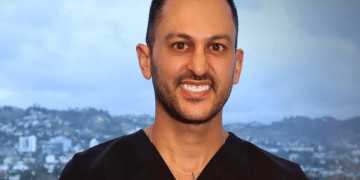

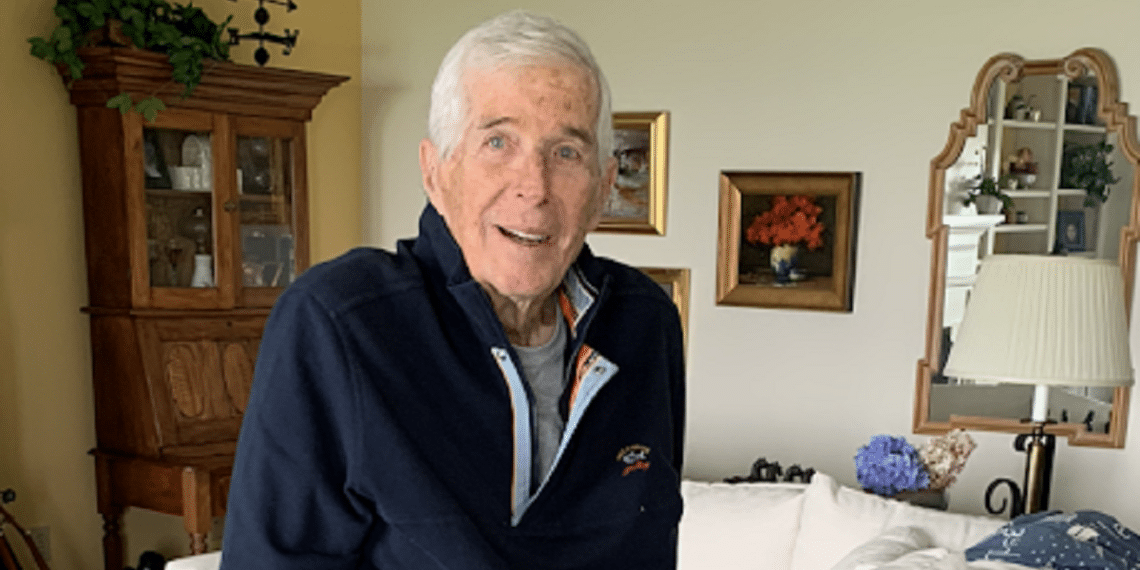

InsMark sells licensed financial software tools to estate planners, insurance companies, and other businesses who need their data to be well-documented and well-presented. Founded by Robert Ritter in 1983, InsMark has no active competitor in the fintech world primarily due to its product logic.

InsMark is a subtle blend of creativity, experience, technique, and information technology to foster insurance companies and other financial firms. Robert has infused all of his expertise into the products created by InsMark. His input is precisely the reason behind its enormous success.

Robert, before InsMark, worked with different insurance companies. While working with them, he spotted major flaws; he noted that the financial data presentation by insurance companies was below par, and the calculation capacity was limited. Also, the available tools couldn’t predict a particular decision’s positive or negative consequences.

InsMark, with its cutting-edge software system, remedied the predicament. It created the InsMark Illustration System, which proved to be an effective tool for producing an attractive and coherent illustration of financial data. The insurance company now adds its numbers data to InMark’s easy-to-use software, and with a few clicks, top page comparative illustrations and graphics appear. This illustration logic is an effective tool, especially for first-time life insurance buyers.

The Wise and Wealthy® system, on the other hand, aids retirement, estate planning, and executive benefit specialists with its core Compared to What logic. Its analytics compares several alternative transactions that help clients choose the optimum scenario that best suits their needs, desires, and expectations. Most clients are uncomfortable with one-product presentations. They respond to alternatives presented in a comparative format.

Apart from these two software tools, the company has other software specifically designed to help businesses reward and retain key executives. For instance, its Split-Dollar System produces a concise, quickly understood presentation for this high-end executive benefit.

Another InsMark system, Life Plan, is also available in Spanish to support foreign life insurance companies and U.S. producers working with Spanish-speaking prospects and clients. Life Plan features a compelling format using InsMark’s do-it-vs.- don’t-do-it presentation magic.

It’s been more than 35 years since InsMark came to the top, and amazingly, it’s been a profitable business since the get-go. Ventures as value-oriented and solution-driven as InsMark usually accumulate high levels of results and respect.